International Supply Chain – Advice and Tips

International Supply Chain – Every firm, whether it trades services or products, has a supply chain. A supply chain is a set of processes and practices which continually evolve and adapt to meet customer demands and changes in the business environment. A company must undertake a detailed analysis of why it needs to create a new supply change or chance an already existing one.

A firm needs to establish a model which will enable it to assess the true cost versus the return of changing or creating a supply chain. The true cost is monetary and non-monetary factors such as communications, culture, and company reputation. I will explore some of these strategic details in a future article. However, I will focus on some operational areas for outsourced production that a firm needs to consider for this article. These areas are:

- Detailed Product Information

- Tariffs & Origin and Import Duties

- Freight & Logistics Elements

- Costs & Cash Flow implications

- Risks

- Management and Control

1. What Product Information do I need to know when Sourcing Internationally?

Time must be spent to list the product specifications.

Know the materials, the standards and the testing requirements of every product.

You need to be able to provide information on the type of packing, printing and labelling, and required accessories.

An understanding of the production process and how it should be monitored and controlled for quality control purposes.

Achieving the above will enable you to assess pricing from suppliers properly, plus it will provide the information for purchase contracts and inspection checklists to be drawn up.

2. How to calculate Tariffs for a Supply Chain?

When assessing potential locations to source products, it is essential to ascertain any taxes or trade restrictions applicable to this location.

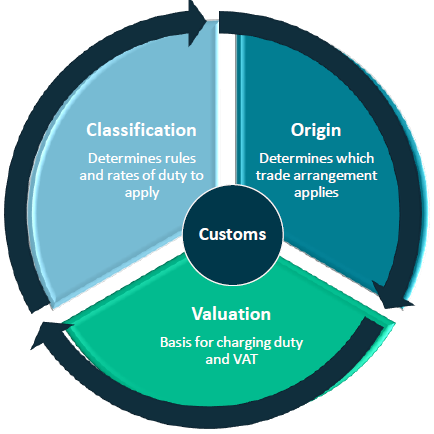

There are three parts that customs use to determine any tariff: Product Classification Code, Product Origin, and Product Value.

Product Classification Code -So What?

Under WTO rules, all products have a pre-assigned classification code.

The classification code can also be called a Commodity Code, HS Code, Combined Nomenclature, Classification Code, Tariff Number, Customs Classification Number, CN Number, Harmonised Code.

You need to find out the correct classification code for your product.

Trade agreements, rules and regulations use these codes, so it is crucial to apply the valid code for your goods.

It would help if you referred to your customs agents to determine the appropriate code.

Here are links to some agencies European Union’s Code System, United States System, and India Customs

Product Origin – So What?

Product Origin is the “economic” nationality of goods in international trade. Duties and charges or any customs restrictions or obligations applicable to goods will depend on where they originated.

Product Value – So What?

The value of a good is the “transactional” value is a “cost plus insurance plus freight” value. Customs duty is applied to this value, and VAT is levied on the total.

3. What are the Freight & Logistics Elements of a Supply Chain?

Logistics play a vital role in any supply chain. Companies can often choose to ship from their supplier to a local warehouse for further distribution or ship directly from a supplier to a customer.

Logistics companies may offer a facility called customs warehousing. A customs warehouse is a building or other secure area where goods are stored without customs duty and VAT payment. It can provide a cash flow benefit for businesses that may import materials in bulk or hold goods for some time before either re-exporting or releasing them into free circulation.

I recommend that firms choose a logistics provider which has a presence in their country. It will ensure that there is a person who you can talk to (no time zone issues) and any cultural issues are removed.

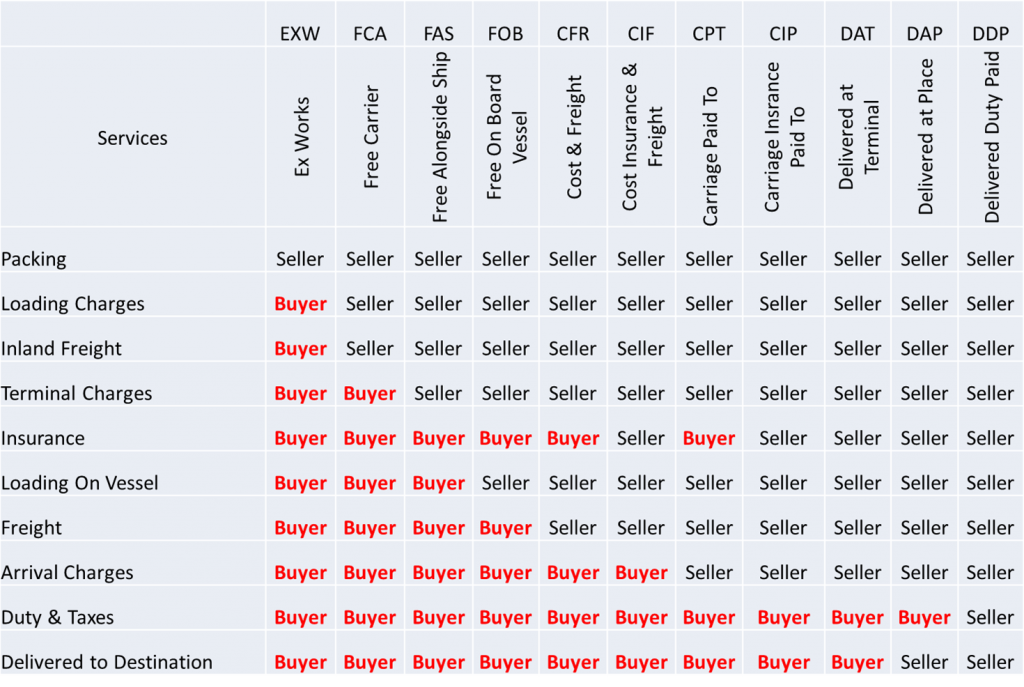

It is vital to understand the different shipping terms and know which party is responsible for which part of the transaction. The table below outlines the various terms and responsibilities.

4. What are potential Costs & Cash Flow implications on Supply Chains?

Companies must factor in two types of costs when setting up or changing their supply chain. These are “Direct Supply Chain Costs” and “Indirect Supply Chain Costs”.

Direct Supply Chain Costs are costs that can be directly tied to the supply chain. These costs can be broken into five cost categories:

- Product Costs

- Cargo Insurance and Quality Control Inspections Costs

- Duties & Taxes Costs

- Exchange Rates & Banking Fees Costs

- Logistics Costs

Indirect Supply Chain Costs are derived from overhead charges or subsidiary work associated with the supply chain, examples include

- Overdraft and financing costs

- Storage costs & Insurance

- Labour & Admin

Cash flow is often a key consideration in determining any potential structure of a supply chain. Strategies include deciding if duties and taxes are paid on goods as they land or paid when sold, shipping in bulk during off-peak shipping rates or shipping smaller quantities continuously across the year.

Matters like the above are vital to maintaining a positive cash flow within a company. I recommend that firms bring in advice from suitably qualified professionals such as Management Accountants (CIMA).

5. How to reduce risks in your supply chain

There are several ways to reduce risks across your supply chain

A. Supplier Verification

It is paramount to verify and audit any potential supplier or manufacturer. You should use the services of professional Quality Control Inspection firms such as Goodada Inspections, don’t fail into the trap of asking a friend or using a local individual to conduct this vital piece of research.

B. Product Quality Control Inspections

Inspect the products before they depart the supplier’s premises. It will ensure that you are not bringing in goods that have defects and will take up valuable warehousing space or damage your company’s reputation.

C. Avoid using Commission Only Agents

Avoid using commission-only agents, they are not on your side, and you will never get the best price. They will always aim to have you paying the highest price. Does an agent want to earn 10% commission on $100,000 or 10% commission on $80,000? Use profession consulting firms such as TCI China for this work.

D. Create Bi-Lingual Purchase Contracts

If you are purchasing more than $50,000 per annum from a supplier, you should have a bi-lingual purchase contract drawn up in your seller’s language. Thee purchase contract should be designed to make it enforceable in the courts where the supplier is registered. It is one of the most important things that you should always do.

6. How to manage an International Supply Chain

There are many different elements to manage in supply chains: production times, quality control, freight, customs, documentation, exchange rates, rules, storage, and despatch to customers.

Many firms bring outside support from several providers to assist them with the coordination and management of their supply chain. Freight Forwarders can coordinate with logistics, customs, documentation and warehousing. My company Goodada can coordinate with the quality control inspections, freight insurance, exchange rates and communications with the supplier. And supply chain consultancy firms such as TCI can help with the development and management of supply chains.

Conclusion

In conclusion, the design and management of an international supply chain is a very complex and dynamic piece of work. So, it is always best practice for any company to bring in expertise to follow up and assist in designing and setting up a supply chain or appraising a current supply chain for improvement.

International Supply Chain Expert: About the author

Aidan Conaty MBA, ACMA, GCMA, is the founder of TCI China and Goodada.com. Aidan has spent over 15 years consulting for companies on their international supply chains. TCI China provides supply chain support services for China. Goodada assists companies to trade globally. Trinity College Dublin awarded Aidan the Seamus McDermott MBA scholarship in 2018.

Aidan can be contacted email at aidan@goodada.com or at:

(Europe/ Rest of the World) +353 1 885 3919

(UK) +44.020.3287.2990

(North America) +1.518.290.6604